Richmond’s Suburban Office Market Update | Recovery in Leading Office Parks

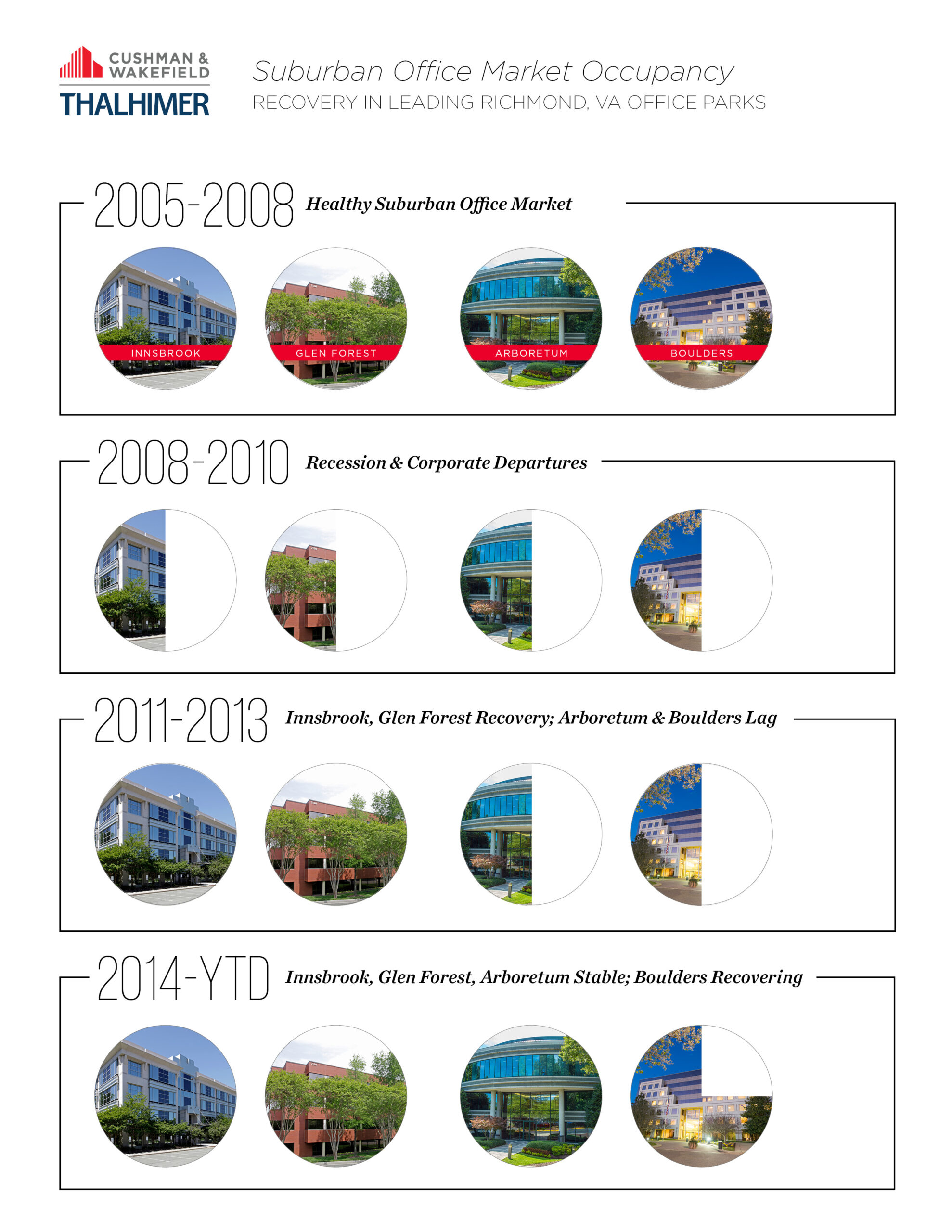

RICHMOND, VIRGINIA: There are four historically top performing, Class A suburban office parks in the Richmond, VA metropolitan area. Two of those parks, Innsbrook Corporate Center and the Glen Forest Office Park are in the Northwest Quadrant and the other two, the Arboretum and Boulders Office Parks, are in the Southwest Quadrant. While these are widely regarded in the commercial real estate industry as the top office locations in the market, there is no doubt that these locations were hit hard by the recession. Three years prior to the start of the recession in December 2007, overall vacancy in these four parks was 5.6%, with no individual park higher than 9.5%. The Wachovia Securities merger with A.G. Edwards in 2008 was one of many events that began to challenge fundamentals in these office parks. In addition to the looming recession, the large-scale bankruptcies of both Land America Title and Circuit City, coupled with the Wachovia Securities move to St. Louis, resulted in large-scale vacancies in Innsbrook which eventually trickled down to other areas of the Richmond suburban office market.

A closer look at the struggles initially faced in the Innsbrook Corporate Center and the subsequent recovery to the largest office park in Richmond, reveals an interesting trend.

Innsbrook vacancy peaked at over 25% late in the recession. Glen Forest was not hit as hard, but still topped out at 19% vacancy in 2009. Post-recession, the northern office parks rebounded faster than those in the southwest, largely at the expense of the office parks south of the river. Innsbrook and Glen Forest began to stabilize in the 2010-2013 period, and were fully stabilized with vacancy rates back under 10% by 2015.

Recent data would indicate that the southern parks are recovering as well. In the southwest, the 2010-2013 period showed little improvement for Arboretum and Boulders. The vacancy rate remained in the 18% range, while absorption was flat. Across the metropolitan area, historically 1% of the available inventory is absorbed in any given year. Arboretum had a 12% absorption rate in 2014 and 8% in 2015, with overall vacancy now sitting at 2.6%. As the only other class A office park south of the James River besides Arboretum, Boulders appears poised to be next to recover. Absorption in 2015 was 3.5% of inventory, and is trending up. Vacancy also dropped 270 basis points from 2014 to 2015, following the trend that occurred in Arboretum, where vacancy dropped 650 BPS in the same period. Brian Berkey, a Senior Vice President at Cushman & Wakefield | Thalhimer, and leader of their tenant advisory practice group notes, “With mid-size and large block space at a premium in the Innsbrook submarket, we are starting to see tenants with an increased interest in the Arboretum and Boulders office parks.”

Brian Witthoefft, a principal with Lingerfelt CommonWealth and office owner in both the Innsbrook and Boulders office parks adds, “From a quality of product and accessibility perspective, the Arboretum and Boulders office parks compete very well with Glen Forest and Innsbrook. The Northwest Quadrant, specifically Innsbrook, has tightened significantly and, in most cases, has exceeded prior historic occupancy levels and rental rates. We are now starting to see the same recovery in the major Southwest Quadrant office parks and expect available space to continue to tighten, particularly in Boulders.”

So while the northwest was hit hard, and recovered faster, the Southwest Quadrant has taken longer to recover but is now experiencing a recovery as the greater suburban office supply is limited. Both Arboretum and Boulders are now outperforming the Midlothian Corridor as a whole, pointing to a forthcoming full recovery in the Southwest Quadrant.